Luxury Hotels Got Especially Large Amounts

When industries mature, they use expanding profits to grow their lobbying influence and obtain not just favorable policies, but government largess in a variety of forms.

In our newly launched look into the hotel industry’s influence peddling, we’re quickly finding this industry is following the path worn by the coal, oil, gas and chemical lobbies: Mature, highly profitable industries getting politicians to give them taxpayer money to underwrite their profits.

The hotel industry’s lobbying arm, the American Hotel & Lodging Association (AH&LA), has been fighting hard for years against an increase in the minimum wage and for shrinking the number of workers eligible for employer-provided health care insurance. It’s had had mixed results. Now the hotel lobby’s latest initiative is to destroy environmentally friendly home-sharing travel offered through such popular platforms as Airbnb. AH&LA scored a victory in New York recently with the signing into law of Assembly Bill A8704C that would enact fines of $7,500 and more on those who advertise dwellings in a multiunit building. The newly signed law is the subject of a lawsuit.

The hotel industry’s lobbying arm, the American Hotel & Lodging Association (AH&LA), has been fighting hard for years against an increase in the minimum wage and for shrinking the number of workers eligible for employer-provided health care insurance. It’s had had mixed results. Now the hotel lobby’s latest initiative is to destroy environmentally friendly home-sharing travel offered through such popular platforms as Airbnb. AH&LA scored a victory in New York recently with the signing into law of Assembly Bill A8704C that would enact fines of $7,500 and more on those who advertise dwellings in a multiunit building. The newly signed law is the subject of a lawsuit.

Hotel Welfare

A campaign the hotel lobby has been very successful at achieving is securing an enormous amount of money, often from cash-strapped county and city governments, despite the maturity and profitability of these long-established hotel chains.

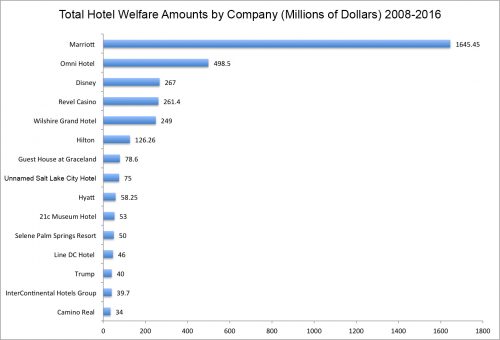

In a survey of 55 news and business media outlets conducted last month, we found that since 2008, 37 parent hotel companies received at least $3.6 billion in direct taxpayer support for 79 unique hotel projects.

Here are the top 15 hotel chains with respective corporate welfare amounts:

Many hotels have obtained special exemptions, rebates and tax incentives that allow them to enjoy significantly lower effective taxes than the nominal tax rates would indicate. The hotel industry also uses a number of strategies to reduce the income taxes it pays on its publicly subsidized profits.

Tax rebates are one of the most common forms of public support for hotels. In such schemes, hotels receive a refund from the local government for payments made on hotel taxes, sales taxes and property taxes. The estimated values of these tax incentives engineered by the hotel lobby, which typically last for several decades, often run into hundreds of million dollars.

Subsidizing Luxury

By and large, taxpayer-financed welfare for hotels is concentrated most heavily on luxury hotels, which cater to the wealthiest travelers.

In California, for example, the City of Anaheim has recently adopted policies that return hefty percentages of local hotel taxes back to private hotel developers. The city’s policy explicitly links the size of the taxpayer giveaway to the opulence of the hotel, granting 70% rebates to four- diamond resorts. Another 20% of hotel taxes collected from the luxury resorts are dedicated to repayment of bonds issued to upgrade the city’s resort district. Only 10% of hotel taxes collected at the new resorts will be returned to the city’s general fund. Under the new policy, other Anaheim hotels can collect smaller subsidies for upgrading their hotels to meet higher quality standards.

diamond resorts. Another 20% of hotel taxes collected from the luxury resorts are dedicated to repayment of bonds issued to upgrade the city’s resort district. Only 10% of hotel taxes collected at the new resorts will be returned to the city’s general fund. Under the new policy, other Anaheim hotels can collect smaller subsidies for upgrading their hotels to meet higher quality standards.

Anaheim Mayor Tom Tait has been a strident opponent of the giveaway to local hoteliers, arguing “our tax money is to use for neighborhoods, not to give back to the hotel developer.”

He said:

“… room taxes would be kept by hotel developers – rather than going back to Anaheim’s coffers to help pay for police, parks, road repairs and other city services. Hotel taxes, projected to be $133 million during the next fiscal year that begins July 1, account for nearly half of the city’s general fund revenue.

“We are giving checks to hotel developers, but we have better needs for our money,” said Tait, who voted against the plan with Councilman James Vanderbilt. “Our tax money is to use for the neighborhoods, not to give back to the hotel developer,” Tait said. “We have needs more than luxury hotels. It makes no sense.”

But Mayor Tait lost to the hotel lobby. Anaheim City Councilwoman Kris Murray voted against him and said, “four diamond hotels aren’t built without subsidies.”

100% Rebate on Taxes in Colorado

In 2013, the Colorado Economic Development Commission approved a 65.8% sales tax rebate for the Gaylord Rockies Hotel and Conference Center in the town of Aurora. The value of the hotel’s 30-year sales tax rebate was estimated at $81.4 million. The hotel’s development was subsidized by a further $300 million of incentives offered by the local government in Aurora. The local incentive package included a 100% rebate on local sales and hotel taxes. The hotel is currently under development and scheduled to open in 2018.

“A state and local government incentive package calls for handing the developer… and its lenders 100 percent of local sales and lodging taxes, plus state sales taxes levied on purchases at the resort once it’s built, for the next 25 years.”

Ranking the States

The Anaheim and Aurora deals contributed to their states #1 and #2 ranking of states that give the largest amounts of taxpayer-financed corporate welfare to the hotel industry.

In the days to come, we’ll take a closer look at localities have been subsidizing luxury by allowing major hotel companies to avoid taxes. We’ll also examine how hotel chains use financial gimmicks to avoid income taxes, how taxpayers have lost millions on publicly owned hotels, and how poverty relief funds have been diverted to subsidize luxury hotels.

You Might Also Want to Read:

What Is Penn State’s Relationship With Hotel Industry Lobbyists?

Is Professor John O’Neill Using Penn State to Run His Private Consulting Practice?

Scott Peterson is executive director of Checks and Balances Project, a national watchdog blog that seeks to hold government officials, lobbyists and corporate management accountable to the public. Funding for C&BP comes from sustainable economy philanthropies and donors.

Recent Comments