Bob Stump has been development director for School Choice Arizona (SCA) for a decade. During eight of those years, he has also been a commissioner of the Arizona Corporation Commission.

Bob Stump has been development director for School Choice Arizona (SCA) for a decade. During eight of those years, he has also been a commissioner of the Arizona Corporation Commission.

Commissioners are allowed to have outside jobs. It’s only when there are legal or ethical conflicts of interest that it becomes a problem. One obvious example is former-Chairman Susan Bitter Smith.

Considering the corruption scandals surrounding the Corporation Commission and the previously hidden fact set around Mr. Stump’s outside job as development director for School Choice Arizona, we think it’s in the public interest to ask these questions:

-

Have donors to School Choice Arizona appeared before the Commission while Stump was a commissioner?

-

Have their businesses been affected positively by an action by the Commission?

-

Has Mr. Stump received bonus income based on the amount of money he has raised from these organizations?

-

How much has he received?

-

Will he immediately pledge to recuse himself from future proceedings if there is a conflict of interest?

Interesting questions, we think, especially in light of Commissioner Tom Forese’s recent announcement that he wanted to create a Code of Ethics for the Commission.

Pocketing fees from donations made by organizations that hope to obtain a favorable ruling from the Arizona Corporation Commission would seem to be a violation of legal and ethical standards.

That’s why we call upon Commissioner Stump to be transparent about his work at School Choice Arizona.

That’s why we call upon Commissioner Stump to be transparent about his work at School Choice Arizona.

In fact, we called Stump’s office twice and left a message for School Choice Arizona but, unfortunately, our calls have gone unanswered.

Steering Corporate Dollars

Two years before he became a commissioner, Mr. Stump was hired as a fundraiser with a commission-based earnings structure for School Choice Arizona to steer corporate dollars to the organization. The law allows corporate donors to claim a dollar-for-dollar tax credit against their Arizona tax liability.

Over the years, when asked about his work for SCA, Stump has steadfastly refused to answer any questions about the corporations he has solicited, including which ones donated to SCA. The corporate solicitation brochure describes the outsized benefits of donating:

C Corporations may donate up to their state income tax liability for the given tax year, as long as it does not exceed the entire statewide cap for the year. If a corporation donates more than their tax liability, it can be carried forward for up to 5 years. (A.R.S. § 43-1183)

On Stump’s 2015 financial disclosure form, he states that his role is “development” with the school tuition organization. Until recently, his name was also listed on the SCA donor form as the organization’s director of development. You can view that old form HERE.

Stump Vanishes

Not long after we began asking questions about Stump last year, any reference to him on the donor form was removed. You can see the new donor form HERE.

Despite calls to SCA during its listed business hours, no one answered the phone, leaving us unable to ask someone at the organization about the status of his employment directly. We left a message and it was not returned.

We also called Commissioner Stump’s office and asked his assistant if Mr. Stump was still SCA development director. She said she would find out. We left a second message, but have received no reply.

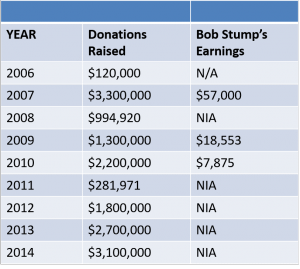

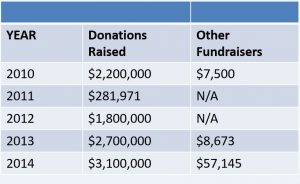

Whatever his current employment status is with SCA, there are outstanding questions. Neither Stump nor SCA have released any data about his earnings since 2010, although it has provided information on the earnings of other SCA fundraisers and executives.

If 2014 was comparable to 2007, Commissioner Stump’s SCA earnings may have been by far the largest when compared with other SCA fundraisers. But Stump refuses to say.

In fiscal year 2014, School Choice Arizona paid $57,145 in fees to pay other fundraisers. (Source: SCA’s IRS 990.)

SCA also reported spending $63,145 in Professional Fundraising Fees in 2014, and a total of $222,503 from 2006 through 2014 on Professional Fundraising Fees. But there is no information listing the recipients of Professional Fundraising Fees.

Also on its 2014 Form 990, School Choice Arizona lists six executives. Only one, Executive Director Marc Weidinger, received compensation totaling $5,111 for the tax year 2014 – small potatoes compared with the fees for fundraisers. Weidinger’s compensation has varied between $5,000 and $10,000 since 2006.

Why So Little Information About Bob Stump?

Questions of ethics and dark money manipulation have swirled around the Arizona Corporation Commission for far too long. Commissioner Stump owes Arizona citizens answers to the basic questions about being a fundraiser that we have posed. Answering them can clarify a murky relationship, assure the public that Stump isn’t using gaps in the law to benefit himself personally, and help to restore a modicum of trust.

Scott Peterson is executive director of Checks and Balances Project, a national watchdog blog that seeks to hold government officials, lobbyists and corporate management accountable to the public. Funding for C&BP comes from clean energy philanthropies and donors.

Recent Comments